A Rental Market Round Up

More Rental Units, More Rent Control, More Confusion

The Bay Area has the dubious distinction of being one of the most expensive rental and real estate markets in the country if not the world. Yet, despite having some of the most progressive public policies designed to promote housing (e.g., below market rate unit requirements, rent control laws, very active Rent Boards) rent and real estate remains very precious and expensive. Rather perversely, progressive housing policies contribute to pushing prices up. But it’s a heated topic and one that resonates with Bay Area voters as the numerous rent control initiatives this November demonstrates. (Take a read here about how passionate it can be when it comes to campaign mailers).

It’s Not Just Rent Control Laws Silly, It’s More

But expensive are also a result of public policy that slows development down (stringent environmental review standards, historic preservation and zoning considerations, infrastructure) while making it more expensive; climate

If You Build It, Prices Will Go Down… Ever So Slightly

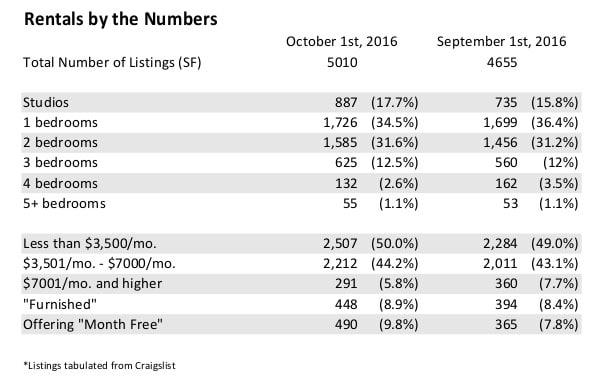

With the stated objective of adding more housing units in San Francisco, public policy planners have streamlined the approval process to the extent they can. The result? More rental units have debutted in San Francisco over the past year. As such you can see some price easing (less than 5% on average from 2015). The chart to the right shows that progress has proven incremental but it’s still progress. But remember all of the units added are usually exempt from San Francisco’s Rent Ordinance meaning they’re exempt from rent control and eviction control regulations and protections.