Sound Off

Appearing in the San Francisco Chronicle Real Estate Section

From time to time, the editors of the Real Estate section at the San Francisco Chronicle will ask leading area real estate agents their opinion and thoughts about various topics related to the Bay Area’s housing market. This is right up our alley given our track record, experience helping buyers and sellers in various parts of the Bay Area and given the fact that Kevin used to be a reporter and lawyer, so you know there‘s an opinion just waiting to get out.

Is the HOA the Fairest of All? The Types of HOAs you may encounter in San Francisco

This Week‘s Question:

What are the pros and cons of a homeowner’s association?

Answer:

The core strength of a Homeowners Association (HOA) lies in its communal governance. Ideally, an HOA manages collective building issues, funds for repairs and amenities, and administrative tasks with minimal intrusion into residents’ lives. Before buying a property with an HOA, it’s crucial to understand the nature of the HOA, as it will impact your living experience.

The pros of an HOA include maintenance and upkeep of common areas, access to amenities, and potentially increased property values. The cons can include high and ever-increasing dues, restrictive rules, and variable management quality.

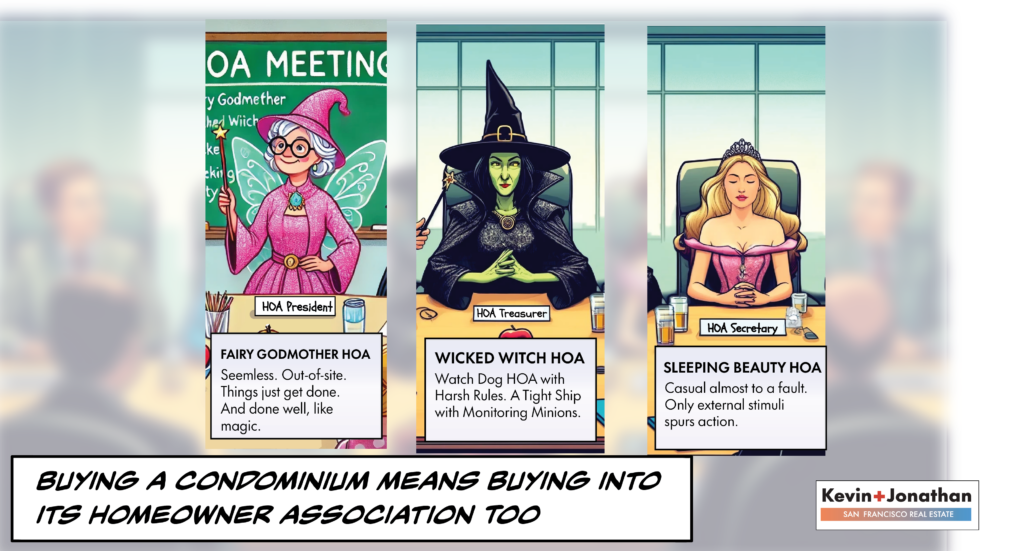

Over the years, we’ve encountered a wide range of management styles. Some HOAs operate so smoothly it feels like a fairy godmother is at the helm, seamlessly making things happen. Others can feel like they’re under the rule of a wicked witch, where rules are enforced harshly in an informant state. And then there are those that resemble Sleeping Beauty’s realm, where nothing happens until it does.

When considering a property with an HOA, investigate all available materials, such as meeting minutes, agendas, and online forums. Talking to current residents can be valuable, as they may be your future neighbors and co-HOA members.

This appeared in the Sunday, June 16, 2024 edition of the San Francisco Chronicle and on SFGate.

Doing Your Diligence on the Kind of HOA You May Join Through the Power of Document Review

Financials

The form that lists regular dues, how an HOA is managed, operating account balances, reserve account balances (i.e., long-term upkeep/rainy-day fund), number of rental units, if anyone in the HOA is in arrears, transfer/move-in fees, and contact information for management/HOA officier. If it is a small 2-3 unit HOA, it is usually just the other neighbor. Lenders like seeing this form filled out by other people in the HOA and not the seller directly.

Legal Authorities

Such things like the CC&Rs, condo map, recorded rules and bylaws.

- Be sure you understand what the definition of what a ”unit“ is, what is exclusive versus common area, percentage of any common area dues linked to the unit you are purchasing.

- Make sure there are no deed restrictions, constraints or limitations like a permanent below-market-rate (BMR) status, rights of first refusal.

- Operating documents, protocols and decision-making procedures for larger buildings.

- Dispute resolution procedures (mediation or arbitration)

Operational

From HOA meeting minutes, announcements, insurance policies, handbooks, move-in/move-out policies, bills, invoices — anything that impacts your day-to-day living.

Specifically...

While not complete (nor necessarily applicable in every case, these are the things buyers should be provided with when considering a condominium purchase. There are lots of variations to these standards especially if there is new construction involved, probate, or litigation.

- The Financial Disclosure Form (aka the condo cert). The standardized form that lists regular dues, how an HOA is managed, operating account balances, reserve account balances (i.e., long-term upkeep/rainy-day fund), number of rental units, if anyone in the HOA is in arrears, transfer/move-in fees, and contact information for management/HOA officier. If it is a small 2-3 unit HOA, it is usually just the other neighbor. Lenders like seeing this form filled out by other people in the HOA and not the seller directly. Most lenders have their own in-house version of this form that needs to be completed during escrow.

- The current version of the CC&Rs (which are recorded with the county) and any recorded addenda, restatements or amended versions

- House Rules, Bylaws or Owner Handbooks (if they exist, more likely in new-build developments.

- The Reserve Study (if any). This is the document common to larger buildings where a qualified professional will calculate what monies an HOA needs to set aside for replacement costs of certain building and common area components along with studies of utility consumption and whether or not scheduled assessments will be sufficient going into the future.

- The current budget and any future ones (proposed and actual). Many smaller HOAs will not have this.

- The HOA’s current bank account statements for 1 year (usually a joint bank account at a bank you would know)

- Any discussion or notices of assessments (upcoming or planned special assessments) within HOA meeting minutes, emails or within the condo cert document.

- 1-years’ worth of HOA meeting minutes. If there aren’t any, what people will usually provide are the email exchanges HOA members had with each other.

- Whatever form it takes prospective buyers need to have a sense of what the HOA has been considering, weighing, and addressing most recently

- Any ongoing kind of issue or question that a prospective buyer would want to know, then this MUST be disclosed. If you need to craft a summary document that may be advisable too but this is key as this is where buyers get the most nervous.Some examples: Leaks in other units that impact the common areas or are a result of issues in the common areas of an HOA (including proposed fixes, estimates, reports or assessments); capital projects or improvements the HOA has been considering like new doors, gates, paint, windows, etc.; issues related to the crime, quality of life or the neighborhood; rowdy neighbors, breaking elevators, reduction of amenities, planned increases, etc.

- The HOA’s Master Insurance Policy and/or insurance summary in its entirety for the current policy hear and/or any renewals or policy binders PLUS the insurance company/broker’s contact information

- Any website and sign-on information/credential for the HOA, and, if the above wasn’t comprehensive enough,

- Anything else you would have like to have seen when you bought

- If there’s any litigation or anticipated litigation

- Any construction plans, reports, receipts, invoices related to HOA common areas that impact the unit’s value (so, routine inspection notices aren’t needed per se, but estimates for work to be done or reports saying that X and Y have to be done to the building or common area are relevant)

San Francisco’s Most Traded Inventory Category (Usually): The Condominium

Take a look at more resources we have about purchasing a condominium below.

There’s This and There’s That

Year-to-date Sales Figures for Single-Family Houses and Condominiums from the San Francisco Association of REALTORS’ MLS.

About Condominiums in General

Our general guide materials about how that condominium you are going to buy is a world away from the aging seaside retiree destination.

What Docs to Examine

Another SF Chronicle contribution outlining the documents you should receive and review when considering a condo purchase.

For More Sound-Off Snippets...

The tech sector has always had its ups and downs—recent DeepSeek-related turbulence is just another entry in the clips folder. But let’s not forget: four of the world’s most powerful tech titans, along with the most promising AI unicorns, remain headquartered in the Bay Area. The billionaires who shaped this industry? Still here. The workers who built it over decades? Still here. Many of these individuals have already realized their fortunes, and for those yet to, restricted stock units help buffer equity market volatility.

How local elections in San Francisco and elsewhere will impact housing decisions that have consequences for everyone and the market with Kevin Ho and Jonathan McNarry, top producing buyer and seller agents with San Francisco’s Vanguard Properties, the leading locally owned LGBTQ real estate brokerage for San Francisco and the Bay Area.

1264 Church Street, San Francisco, a sunny, top-floor, 2-bed, 1-bath, 1-car parking garage space with ±1,284 sqft (per LiDar) as listed by Kevin Ho and Jonathan McNarry of Vanguard Properties. SF MLS 423910006. www.1264-church.com At the heart of this stand-out property is the newly renovated chef’s kitchen (designed for cooking classes and entertaining), the new bathroom, new, in-unit laundry, new stainless appliances, dual pane windows, wood floors and designer lighting. Combined with its 1935 Spanish-revival heritage in a sought-after Noe Valley location, 1264 Church is exceptional.