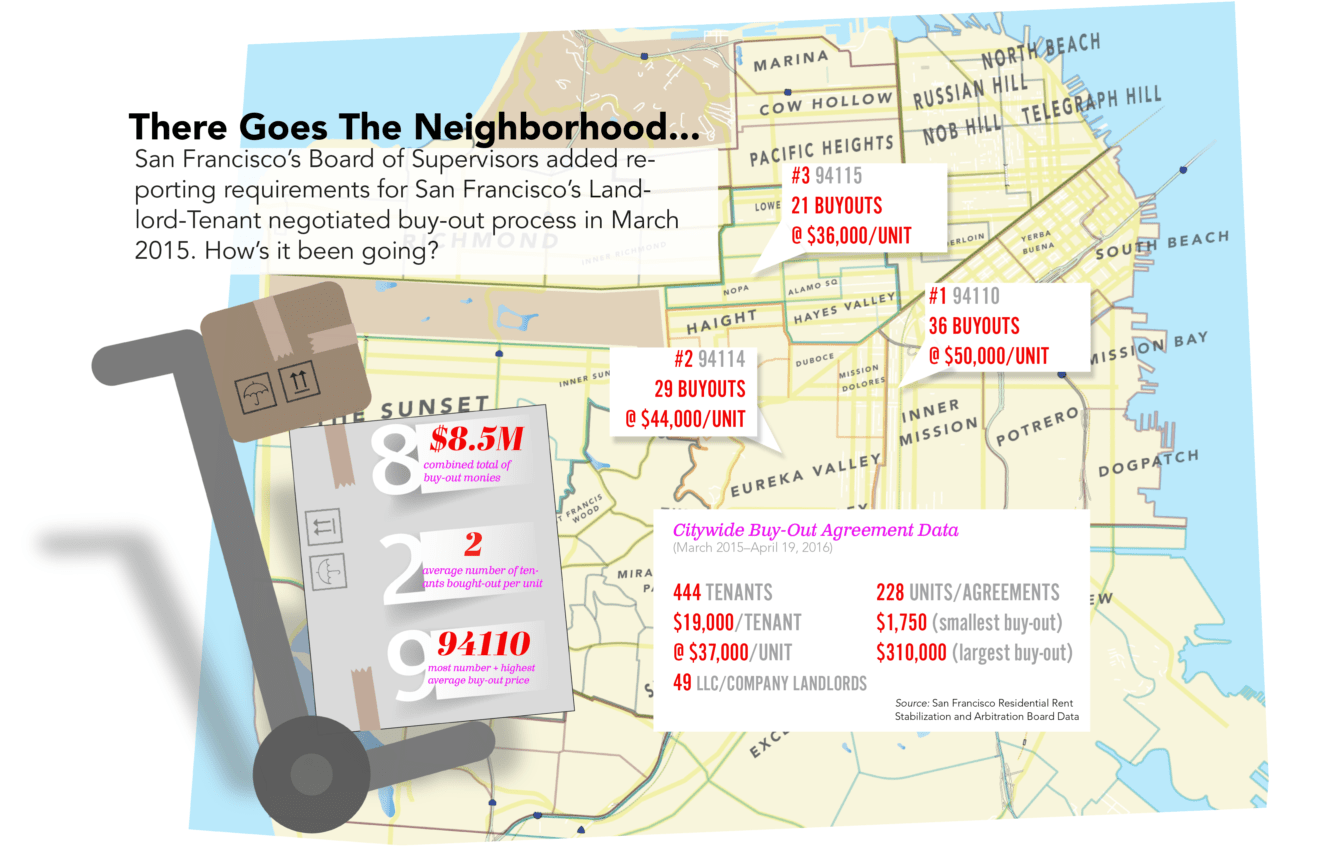

How the City Has Changed Since New Landlord-Tenant Buyout Provisions Went Into Effect

On our way back from an appointment at City Hall to confirm a new listing that we will tell you about in future posts (very exciting) we stopped by the Rent Board just because. Really, just because. Why? The folks there, no matter how busy, are among the most knowledge and friendly in the City and have copious amounts of data on rental units, evictions and, since last year, buyouts.

San Francisco changed its policy for landlord buyouts of tenants forcing the parties to register buyouts with tenants a little more than a year ago. Apart from having to register the buyout, landlords are now required to give tenants a written disclosure outlining the process and the tenant’s right to change their mind even after an agreement is struck.

The system was an attempt to regularize the system but leads to confounding results and perplexing questions especially if a landlord’s goal is to take the building condo. If the buyout involves more than 1 tenant than the chance to convert evaporates until 2024 or later. Moreover, if there is a single tenant occupying a unit if that tenant is protected that also renders the unit ineligible for conversion, even if the tenant is more than willing to take a buyout. We called his issue out when the policy first came out and wondered if that it would give rise to a spike in Ellis Act evictions, which mandate certain relocation costs and notice period. Why? Ellis Act fees are less than historic buyout agreement prices, which are not regulated. Ellis Act evictions also render units un-rentable for anywhere from 5 to 10 years depending the circumstances. But if the goal is to simply sell off those vacated units as individual TIC units to get out of the rental business then the Ellis Act route would be the cheaper means to get to that end.