The fact our listing in NoPa at 1608 Fulton Street went into contract just 4 days after we launched it on the MLS, should be indicative of the transformed nature of San Francisco’s 2019 market. Just last fall prices were slowing and properties were taking longer to sell. That’s because the stock markets fell, forest fires burned and literally choked the air outside and everyone was more focused on the midterm election.

This spring’s market couldn’t be more different with multiple offers and surging prices. We chatted with the appraiser who came to our listing today and here are some takeaways from our chat:

- Comps (comparable sales) from last fall aren’t helping sustain or support this year’s sales,

- Appraisers working today are really looking long and hard for comparable sales to justify current contract prices. While stretching last year’s sales data is one way of getting that task done, reaching out to other agents and appraisers for properties that are currently pending is the other way to do it.

- As true with years past, no buyers (at least the ones who actually get houses into contract) are including appraisal contingencies in their offers.

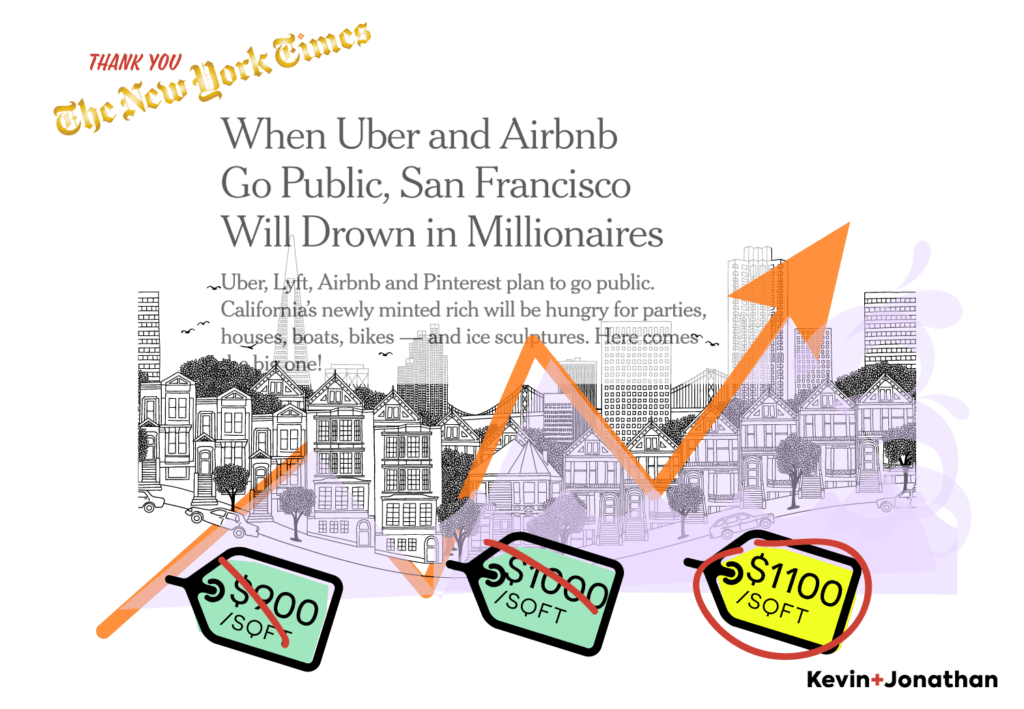

- Average per-square foot prices for properties under $2,000,000 in San Francisco are now hovering around $1,100/sqft with smaller units pushing into the $1,700/sqft range. We’re still not quite at the $2,000/sqft range…. yet.

- And yes, the low-list price-crazy-contract-price game is still going on out there with agents still listing their properties for less than market value which is intended to draw attention and multiple offers competing with each other.

The reason for this big surge of purchases and prices?

The appraiser we talked to today attributes this push to that same New York Times IPO-about-to-hit-San-Francisco-real-estate article as being the trigger for this overnight transformation of our marketplace.

Indeed, buyers are taking the hint of trying to buy before waves of IPO monies are freed up, but as we’ve said before, that time is still in the offing.