If you’re applying for a loan, be sure to get ready to scan/PDF and/or ask for a lot of the following information for your would-be lender. Be sure to keep copies as it’s likely that you’ll be asked for the same docs many times and start early. There will be tons of questions, clarifications and digging for docs that can add a lot of time to the pre-approval and approval process, which may lead to unnecessary delay in getting your financing ready that will lead to a weaker offer. Best practice is to get ‘super approved’ (i.e., fully underwritten) first and after we get your next property into escrow all that will be left is to confirm your creditworthiness and the property’s condition and contract price (by appraisal)

Starting the Financing Application Process Right

While there’s more to come for sure, we wanted to give you the first steps in tacking the home mortgage application process which will most likely be the most annoying part of the entire home buying process.

Yes, San Francisco and the Bay Area are expensive places to buy property. Good thing that there are lots of ways to buy a home. While cash is king, all-cash offers aren’t always the offers that win. We explore some of the potential options for financing your purchase, but here is the documentation that most lenders will want to review. Remember your circumstances will be different so be aware of that.

HUNT+GATHER

A lender will only speak in generalities until they see your paperwork as they need documentation, documentation and more documentation. So you should start by gathering these materials and you should keep the originals and PDF them as you’ll have to send these materials in at least a few times.

Last 2 years of W–2s &1040s for self–employed and/or tax returns (personal & business returns

FILED (e.g., 1120, Sched. K–1) Last 2 pay stubs & employer verification/ability to do so easily; year-end pay statements, 2 years

Last 2 months bank statements (checking, savings, IRA, Money Market, etc)

Credit report fee (banks pull their own), you could provide your own to avoid multiple inquiries but they'll eventually get their own

Photo I.D. (Driver’s License, Passport, Green Card, etc.) (VA letter/certification)

Landlord contact information 12 months proof of rent payments; i.e., canceled checks, statements, etc.

If you’re getting RSUs, vesting schedule showing award amounts and payouts

Gift Letter from relatives/investors; don’t forget they can ‘loan’ you money through forgivable loans

All cash? Funds verification/bank statement

Changing jobs? Offer letter from new employer (potentially, 1 pay stub from pay cycle of new employer)

For current homeowners: current mortgage statement/sales contract

Various HUD & lender application materials

Whatever underwriting requests Explanatory letter for any special cases or situations

If you have any questions about documents or special circumstances it’s best to CALL your lender rep versus emailing them.

What Questions Can We Answer?

There’s a lot to digest here we know. Feel free to ping us if you have something you’d like to ask us.

Factors to Judge Lenders By

Most of the time a lender is judging you and your finances, but remember you are the consumer. So here’s the time where you can judge them. There are two areas we focus on: can the lender help us get our offer accepted and can you live with the terms of the mortgage you get.

As your agents, we will be concerned with how fast a lender can close the purchase which is how fast they can get an appraiser to a property (which became a real issue since the Pandemic started), how fast and how deep their underwriting will go and and if the lender really knows San Francisco’s market well because our numbers are higher and the circumstances are unique unto ourselves because listing agents will take notice of these things.

As a borrower, here are some of the things you should look out for:

- Are there origination points (i.e., lender fees to even do the loan)?

- What (and how much) are post-close reserve requirements and what can be counted as such? (i.e., if you lost your job, how many many months of the mortgage can you pay from your assets that isn’t already part of your cash down payment; stock options, RSUs and retirement funds may not be credited 100 percent either)

- Early prepayment penalties, if any (that make refinancing or early sales less advantageous)

- Number of appraisals required for your purchase, even if it’s not a contingency (if each appraisal costs close to $1,000 . . .)

- Underwriting duration, as in how long it will take for them to close the purchase from when the offer is accepted to when we have keys

- Reputation and ethics

- How vigorous are their underwriters? (and how forgiving they are)

- Down payment requirements (10, 15, 20, 25, 30, 40 percent?)

- How often credit is pulled (and how long a pre-approval lasts)

- If you can be ’super’ qualified before we make an offer (i.e., can you be fully underwritten before we make an offer and how long that takes)

- If a lender is willing to have a second mortgage follow their first mortgage

Try Out A Mortgage For Size

THE LOAN TYPES

We’ve seen them all and worked with them all too, but you may not have so let’s examine them, shall we?

Jumbo the Loan

The Most Likely Loan You’ll Get Here...

This is what most people tend to get in San Francisco, so let’s start with it.

The Jumbo Loan

Jumbo Loans (20 Percent or more down)

This is the most common loan type in the Bay Area because our real estate is more expensive than what Freddie Mac and Fannie Mae allow (see below). Because of this, lenders have more free rein to structure their jumbo programs and may apply or emphasize different underwriting criteria depending on who holds the debt after close.

Most loans require at least 20 percent cash down payments with some lenders requiring 25 percent (or more) depending on the loan amount (usually for loans of $2M+). There may be lender points, you may be able to buy down points as well. Jumbo rates usually vary from conforming conventional rates by 1/8th point (lower or higher) depending on macro economic conditions.

While most loans have mortgage interest rates fixed for 30 years (the 30-year) there are also ones that have that mortgage interest rate locked in for a relatively shorter time period with annual adjustments after that initial period; so a 5:1 loan is one that is nevertheless based on a 30 year repayment schedule but where the interest rate is only fixed for the first 5 years of the 30 with annual adjustments for the remaining 25 years. Most ARMs are paid off well in advance of that however.

Reasons to Get an ARM vs a 30-Year Fixed Loan

- Monthly cash flow increased by a few hundred dollars

- When a property’s character will change substantially in a few short years, i.e., a fixer upper, a TIC that converts into a condo

- In a high mortgage rate market where the general consensus is that rates will decline in a few short years

*2022 UPDATE

- Given rapidly rising mortgage rates in light of the Fed’s ongoing campaign to fight high inflation, ARMs are becoming the loan of choice for many: get the now-lower-list-price property with an ARM and then re-fi and/or sell it when rates are lower again.

- Thanks for fluctuating rates, many lenders are now moving to 6-month adjustments instead of annual ones. Instead of seeing 7:1 or 5:1 loan types (fixed for X years and then adjusting 1x a year), we have already started to see 7:6 or 5:6 (locked for X years, and adjusting 1x every 6 months after the fixed period ends) all in an attempt to keep home loans going and to placate would-be investors on the mortgage markets.

The Conventional

Maybe this type will work.

Usually a non-starter in SF, recent changes make them viable here now.

Conforming Conventional Loans

Conforming loans are ones that comport with Freddie and Fannie loan guidelines (maximum loan amounts)

San Francisco, being one of the most expensive markets in the country, has a conforming loan limits well above those in the rest of the country. For 2023, the FHA conforming loan limits went higher and are $1,089,300 for condos and houses; $1,394,775 for 2-unit buildings; $1,685,850 for 3-unit buildings; and, $2,095,200 for 4-unit buildings.

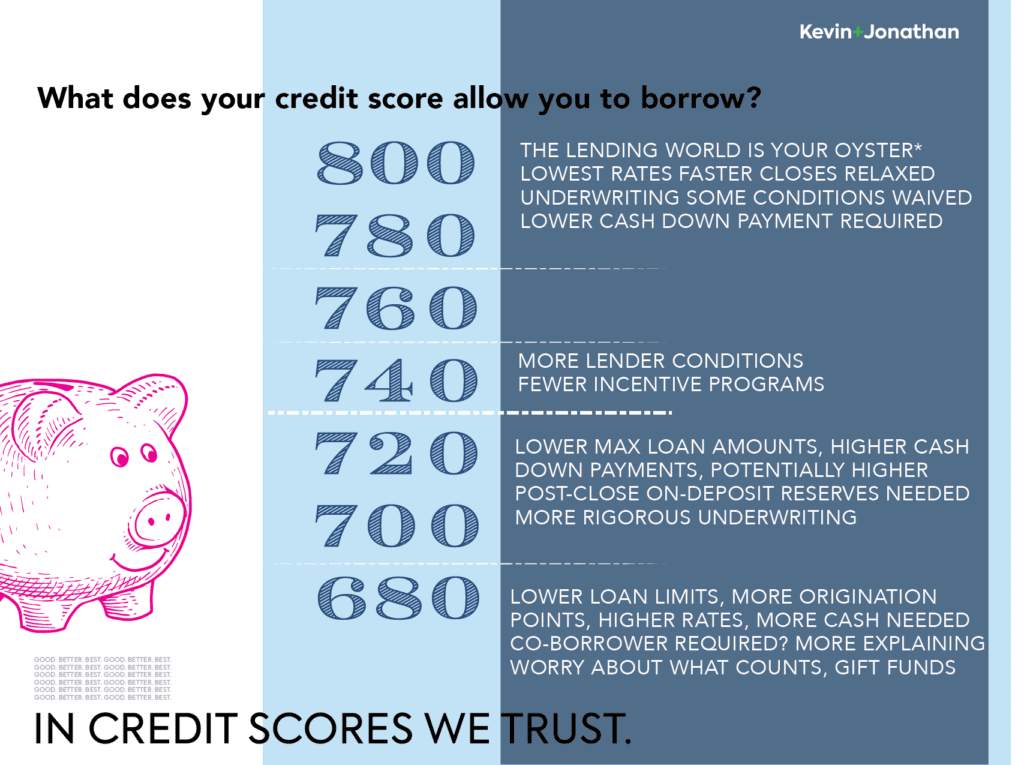

Typically, these are fixed rate, 30–year (or 15) with no pre–payment penalties and a minimum of a 20 percent down payment. Borrower’s debt–to–income ratio requirements vary and may be more lenient than the maximum 45 percent of your monthly gross income can be spent on the mortgage payment. Sometimes the lending guidelines for conforming conventional loans are more stringent than Jumbo loans. Credit score expected: 740.

The power of the conforming conventional loan is that there are times where the exceptions that can be made for X, Y or Z, things like property condition, income questions, credit history, may be more wide encompassing than their jumbo loan brethren. The lending guidelines are hundreds of pages long with charts and tables and questions, so it definitely requires professional help to wade through it all. Check out FannieMae’s site here for updated limits and explore some too while you’re at it to learn more.

FHA Loans

FHA loans in . . . San Francisco?

Available all over the country (but with lower purchase price limits), various mortgage programs that government-backed may not be viable here in the Bay Area given our prices.

The main draw is that cash down payments can be as low as 3 or 3.5 percent of the purchase price with most of your closing costs and fees being folded in the with the 30-year fixed rate mortgage. DTI ratios are more generous (up to 51% in some cases) and, with 2023 loan limits for high market areas like San Francisco being raised to all-time highs, seem like viable way of getting into real estate. (Current 2023 loan limits range from $1,089,300–$2,095,200).

BUT here’s the rub: mortgage insurance. Some programs like the HomeReady loans allow you to remove the monthly cost when you reach 20% equity in the property, while other FHA variants may not. Check with your lender.

And one more thing: if you want to buy a condo (which is the only property type with any hope of being within high-value market ranges, the building (HOA) must be FHA-approved, which is a long process that many developers and HOA choose to skip in San Francisco. Moreover, most buildings (including that charming Victorian) in San Francisco are not FHA-approved because FHA-loan limits were simply too low historically to make the effort of getting approved worthwhile. With new loan limits though, this may change some with higher borrowing limits but FHA-approved buildings still remain the exception. Credit score expected: 720.

The 80:10:10

SPECIAL LOANS: The 80:10:10

Usually, supplemental mortgage insurance (MI) is required for borrowers who put down less than 20 percent toward a property’s purchase price for buyers getting a single mortgage loan.

But for well-qualified or otherwise-qualified buyers (e.g., incentive programs from the Mayor’s Office of Housing) it may be possible for a buyer to do a 10 percent cash down payment with a second 10 percent mortgage (a second or junior loan) to the main 80 percent mortgage (the first or primary) without having to pay any mortgage insurance.

The second loan may be akin to a home equity line of credit on the property being purchased that, through the power of compounding interest, may have a higher interest rate or extra upfront points that need to be paid at closing.. Some of the costs from a second may not be tax deductible. Strong credit (mid-700s) required.

Hard Money

SPECIAL LOANS: HARD MONEY

As the name implies, these loans are not loans from the usual suspects (or, if they are, these are the most aggressive loans they will have in their battery of lending products). These may be locally held portfolio loans. These are the most flexible, short-term but expensive loans to get (relatively speaking, they can be 2x the going rate or more). Usually required for unique situations where property is not otherwise lendable (construction, fire, foreclosure, under litigation) — in other words, when cash isn’t an option.

Census Tract

SPECIAL LOANS: CENSUS TRACT (3–10 percent down)

There are certain loans available for specially-designated qualifying Census tracts. The designations are based on U.S. Census median income data which will highlight areas that need a boost of homeowners. Lenders are either required to carry mortgages in these areas or obliged to by the powers that be.

Requirements for borrowers may vary with income caps or otherwise, and not at all lenders will have these types of programs either. And qualifying tracts will and can change over time. The main benefit is that these loans will allow buyers to put as little as 3–5 percent down to purchase a property without having to pay for mortgage insurance either.

For more, take a read here.

Bridge Loans/Departing Residence Loans

SPEICAL LOANS: BRIDGE LOANS + DEPARTING RESIDENCE LOANS

Type of loan that allows you to buy your next home while you still live in your current one with the expectation that you sell the current house once you close on the new one; usually 12-18-month time window. You may even finance your destination home’s down payment. Compare with other programs like a departing residence loan whereby you have your second home’s down payment already. Rates and limits vary by circumstances.

Uh-Oh

Pear-Shaped?

Lending and underwriting are usually the most nerve-racking parts of any home purchase as many things can go wrong. Rest assured that we’ve probably seen it before and can guide you through it.

Assuming we got your pre-approval and got you into contract for a property things should be smooth sailing until we close escrow. But things can (and do) come up that will to be fixed. Not all problems will have a workable solution but many may if time is given to solve them. So instead of canceling a contract immediately, remember there are alternatives to consider.

Some of the more common issues that interrupt an escrow:

Unexpected job lay off

Stock portfolio value drops

Job change

Company/employer being bought

Tax transcript availability

Change in health

Gift money tracing

For condos, HOA certification issues/construction/litigation

Property is deemed to be in too poor of condition for approval

Seller title/vesting issues (creditors, relatives claiming ownership rights)

Title insurance not being allowed/issued

Credit report mistakes

Appraisal shortfall/mistake

Pest report disclosure

Loan rep availability

How will a lender issue impact an escrow timeline

Most lender/underwriting issues (conditions) can be resolved within a day or two. But if the issue remains open then an extension from a seller will usually be needed if there is no financing contingency (even if there is one a delay may be needed). Whether a seller will accommodate such a request will depend on a variety of factors apart from appealing to a seller’s goodwill. For example, if there is a back-up offer that is higher and better than your offer, you may not get any extensions, but if there are no back-up offers and/or the fault is with the property itself, then a seller would likely be more inclined to grant an extension.

FOLKS WHO CAN HELP

We’ve worked with a lot of folks who have helped our clients get their homes. Reach out to them to see if they’d be a match for you.

Conventional Purchases, Houses, Condos, Multi-Unit

Tony Alencar

Citibank

Home Lending Officer

(415) 215-1239

[email protected]

NMLS # 484714

Bridge, Portfolio, Unconventional

Patrick D Skovran

Boston Private

NMLSR #453408

SVP Market Leader – Residential Lending

415.806.8980 cell

415.402.3140 office

[email protected]

Conventional Purchases

Sean Patrick Farrell

Wells Fargo

Home Mortgage Consultant

Residential Lending

NMLSR ID 507300

Wells Fargo Home Mortgage | 555 12th St., Suite # 2140 | Oakland, CA 94607

MAC A0240-212

Cell 510-220-6859 | e-fax 866-720-7654

[email protected]

Mortgage Broker/Portfolio

Peter Barnes Cross Country Mortgage NMLS # 239580 1385 Shattuck Avenue unit B Berkeley, CA 94709 Office # 510.647.5326 Cell # 415.302.3398 [email protected]

Construction, Purchase and Renovation, Development, Mortgage Broker

Connie Buchanan

Stephanie Hoff

California Real Estate Loans

NMLS #241170 & DRE #01200004

APMC dba California Real Estate Loans, Inc.

600 N San Mateo Dr, San Mateo, CA 94401

Cell: 415-999-2172

Tel: 650-342-4466

Fax: 650-342-9504

[email protected]

Unconventional, Investment, Remodel

Leman J Woo

Loan Depot

NMLS # 916227

Senior Loan Consultant

700 Airport Boulevard Suite 280

Burlingame, CA 94010

(650) 993-7580 office

(415) 812-2934 cell

[email protected]

General Information Only.

Remember that the advice above is just for information only and that your situation, circumstances are unique to you and that you should consult a financial professional before proceeding with any application for credit. Things in the financial sector can and do change with little or no notice, so keep current. Also, referrals above are to lending professionals we’ve worked with previously but that we receive no consideration, rebate or otherwise from the folks listed above. You must make the right choice for you exercising your own judgment and assessment.