Because a condominium unit in San Francisco is usually exempt from all or some of the Rent Ordinance and because San Francisco is (and has been) a boom town with a housing crisis de jour, converting (or subdividing) apartment units into individually owned condominiums can be controversial and is, therefore, highly regulated.

2022 UPDATE:

All of the complex and seemingly contradictory material you’re about to read is emblematic of San Francisco’s real estate market in general: land is scarce, housing is scarce because building anew, remodeling or even demolishing a building everyone that agrees deserves to be torn down is heavily regulated and can take an incredibly long time. For developers trying to redevelop our Fair City this means carrying costs with no income. Combine this with renter’s rights issues, mandated inclusion of low-income buildings, the passage of Prop 13 that caps property taxes for California landowners, and regulation of tenant-buyout agreements, then you have the appropriate context to begin understanding why this topic can be so prickly. Because this intersection of housing policy, law, real estate and social issues is ever-changing, you must consult attorneys who practice in this field every day!

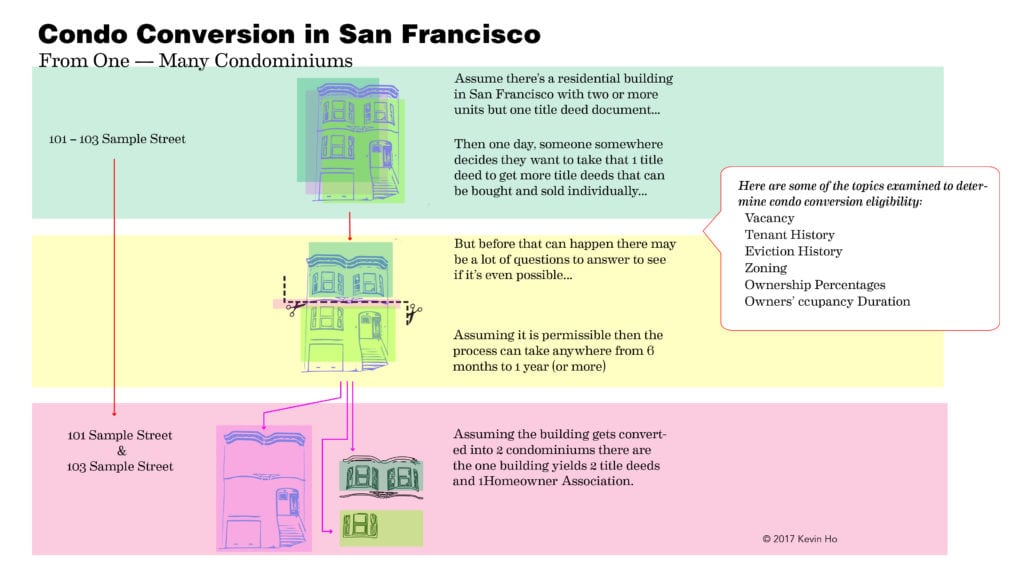

Condominium conversions can happen in a few ways:

- From new construction

- From existing buildings that undergo a subdivision

- From existing parcels with more than one structure on it or another that gets built [this excludes ADU units which usually are subject to Rent Control, but this too is in flux with SB 9 and the City’s response to it. SB 9 allows up to 4 units on a previously zoned RH-1 parcel. The legislation (now law) is intended in increase density as a response to the state’s housing crisis and allows upzoning applications to bypass local regulations or extended discretionary review for example. This area still remains unsettled.

We’re going to focus on the second category here as it’s the most confusing, potentially contentious but also the most contextual. There are three general categories of condo conversion:

- The 2-Unit Bypass.

- The ECP

- The (suspended) Lottery.

But before we delve into the details, we should start as to why this confusion exists. And for that, we start with the San Francisco’s progressive Rent Ordinance.

The Rent Ordinance…

Starting in 1981 after numbers of long-term tenants were put out after their apartments and SRO units mainly in the Tenderloin/Lower Nob Hill were converted into condominiums and the threat of the ‘Manhattanization’ of San Francisco was looming, the powers that be began tinkering with laws covering condo conversions. Why condos? Through another complicated set of facts, condominiums (and most single family houses) are exempt from rent control restrictions.

Condos built after June 13, 1979 were mostly exempt from both rent control and eviction control for the most part until 2020/2021 when state law and San Francisco law changed that placed rent protections for buildings older than 15 years (it’s a rolling date) and took away the right of owner/landlords to serve a 60-day notice to condominium tenant without a defined ‘just cause’ and/or relocation payment.

The Lottery: The pre-2013 condo conversion system was somewhat predictable —

In balancing the desire to allow property owners to own a condo while also protecting tenant rights, came the condo conversion lottery, which limited conversions of eligible buildings each year to just 200 that was done by a complicated, weighted lottery. The law was (and is) confusing: two-unit buildings are presumptively excluded from the system lottery system would be subjected to the system if one unit was rented. Some buildings that were comprised of 100% owners — presumptively eligible for the condo lottery as it became known — were deemed ineligible for conversion because of past evictions that current owners had nothing to do with. Indeed, only 2-unit to 6-unit buildings could be eligible to enter the lottery only after X number of years so long as there were certain ratios of owners versus tenants, a ‘clean eviction history,’ and only after a certain number owner-occupiers lived at the property for a minimum number of years. And, after this, came the actual weighted lottery where chance played a huge part —some six unit buildings converted within 4 years of entering while others hadn’t won even after 7 years.

But in 2013, as the City’s real estate market and rental market woke up from the Great Recession, public policy changed. After a lot of back and forth, competing initiatives and contentious deliberations the Board of Supervisors brokered a somewhat random but somewhat rational compromise that suspended the lottery until 2023 at least and made significant changes for when it comes back that limited conversion to buildings with 4 or less units; 5- and 6-unit buildings that couldn’t otherwise convert as of April 15, 2013.

The Documents and Website You Want to Look at

- The Department of Public Works on Subdivision (which is what you’re doing)

- For Two Unit Buildings

- For ECP Buildings (3- to 6-unit buildings, 2 units with one tenant)

- For Condos from New Construction

The Current ECP System and Its Schedule (Updated 2023)

After a bunch of hand ringing and deliberations, the Board of Supervisors enacted sweeping changes in 2013 that suspended the lottery in favor for an ‘expedited’ schedule. The lottery is suspended until 2023 or 2024 and when (if) it does return 5- and 6-unit buildings that would have been otherwise eligible to convert under the old system will no longer be allowed to convert. One impact to be aware of: Owners of buildings that would have otherwise been eligible to condo convert may now be more willing to get out of the rental business instead of waiting to concert by using the Ellis Act to clear a building of its tenants thus turning the units into tenancy-in-common units for sale that, even sold at a relatively low price per unit, still adds up to more than what the building would be worth as an investment property. The schedule asks a bunch of questions regarding owners, tenants, years of residence and then sets out a schedule of when a building can convert.

Buh-Bye Buy Tenant Buy-Outs?

To make matters even more confusing, in 2015 the Board of Supervisors enacted regulations concerning tenant buy-outs, i.e., agreements that allow landlords to ‘buy out’ willing tenants without the landlord having to resort to unsavory No-Fault or Ellis Act evictions. Previously innocuous buyouts may now actually disqualify a building from converting into condominiums but, contrary to previous thought, buyouts should not impact ECP units nor 2-unit bypass conversion buildings.

Specifically, for non-ECP buildings or bypass buildings, to avoid adverse consequences for condo conversion buyout are limited to units having only 1 non-protected tenant on a lease. Units where 1 protected tenant or 2 or more tenants are bought out would be barred from future condo conversion. Buyout agreements also must be in writing and must be registered with the Rent Board with the tenant having a 45-day right to change their mind. (See Rent Ordinance, Art. 37.9E).

What this means is that even if there are ready and willing tenants who wanted to be bought out may lose any bargaining power if future condo conversion is off the table. Note, ‘protected’ status (disability after 5 years of residency or age and disability after 10 years of residency). Amounts for buyout agreements that pass muster average around $20,000-$40,000 per tenant, which are double statute-based relocation payments.

And if the rules seem contradictory or cobbled together they were as the Supervisors negotiated the big-picture items while the details were left unclear. (Remember these eligibility rules do not apply to newly-constructed condo buildings where its first Final Certificate of Occupancy was issued after June 13, 1979).

And Now For the Actual Conversion (Subdivision)

Once you’ve been deemed as ”eligible“ (well done!) the conversion process will then wind its way through various city departments. Conversion times ranged from a few months to a year and everywhere in between. Keep a careful eye on things as the process will take as long as it does. Do keep watch over the process as mistakes or omissions can and do happen from lenders, city officials and even escrow officers.

Check out the City’s Conversion Flowchart Here

Step 1. Eligible Applicant Owners Decide to Convert and Apply:

- Apply for building inspection; Hire Licensed Surveyor, Lawyer & Title Company

- Hire an expert and local lawyer assists owners in gathering & checking docs like the 3R report, surveyor maps, and assembles conversion application packet to submit to the DPW (Department of Public Works)

- Hire an expert and local title company to handle the ‘official’ paperwork, pull preliminary title reports and to record future HOA documents, maps, and to handle existing and future mortgage loans, document recording and proper title assignment and vesting

Step 2.1. The Lawyers Create Your Future Condo and HOA Documents

- The lawyer you hire will either recommend a title company and/or work with a title officer to prepare the applicable and future condo/home association governing documents, e.g., Conditions, Covenants and Restrictions (CC&Rs), Bylaws, Articles of Incorporation). It’s important that you (read these as they will impact who gets what rights, which parts of a property are owned by whom). Usually these documents are boilerplate but be attentive as it’s not always one-size-fits all.

Step 2.2. Other Professionals You Hire

- The lawyer you hire will may also recommend a surveyor to map the site and an accountant/CPA to create HOA budget documents and reserve studies (depending if the building is big enough

- Contractors and Professional Tradespeople (see below)

Step 3. Enter the Department of Building Inspection (DBI)(6 weeks to ?)

- The DBI will send out inspectors who will look at a property’s permit history, its electrical, plumbing and overall construction and compliance with applicable building codes

- Onsite inspections should start within 6-weeks turnaround from application (actual time will vary)

- The DBI would like to see separate power meters and boxes for each unit plus a common meter for the building’s common areas, ideally 2 water meters, updated energy efficiency and water conservation compliance along with other ‘health and safety’ regulations

- Owners fix violations if any, execute updates; inspector(s) re-inspect and ultimately sign-off

- Issues Certificate of Final Completion & Occupancy

Step 3.1 Enter the Department of Public Works (DPW)(2-4 weeks)

- DPW staff will review inquires to the City’s Human Rights Committee, Rent Board regarding eviction history, zoning issues, and sidewalk conditions.

- DPW processes all of the approvals its receives

- Issues Tentative Approval, which needs the Occupancy Certificate from DBI and Preliminary Map approval (if selling a unit, it can be marketed as a condo to-be now)

- Towards the end of the process, the DPW will review draft survey and condo maps and once the documents are satisfactory it will request the surveyor prepare a Mylar map that will be the recorded public map of the subdivision

Step 4. The Documents At Recorded

- Mylar maps filed, CC&Rs filed, notarized, Lending issues resolved (payoffs, reconveyances of previous mortgage(s)), cross deeds recorded

- Owners prepay property taxes

- Title Company collects, coordinates & records CC&R documents, maps, exhibits

- New titles issued. Done! NOTE: Any Group or TIC Loan must be Refinanced and Close too and each new condo owner can ‘take out’ a new loan based on the now-increased equity they hold.

What Will You Be Paying?

- Supplemental fee ($20,000/per unit)*

- Application Fees ($900±0)

- Surveyor Costs ($5000)

- Lawyer’s Fees ($3000±)

- Prepaymant of Property Taxes based on a new assessment for 1 year in Advance

*Subject to change May not be required, discounts may apply

For more, read here: https://www.andysirkin.com/Index.cfm?Page=15&Hit=1