Condominiums Considered

Condominiums reflect both an entry point into our market as well as a potential destination — from a Diamond Heights studio to a downtown penthouse with amenities galore — both types of condominiums are important bookends of our diverse market. Because condominiums are the most commonly traded property type in San Francisco, it becomes all the more important to examine the ins and outs of buying a condominium.

Perhaps when you were growing up when you heard that your recently divorced aunt had moved into a condominium you may have thought of a townhouse style place among countless others that were pretty much identical with thin walls, weird carpet and a bit of tired air. Or maybe when you heard about a condo it was another set of relatives who retired and moved to a big tower/condo block next to the beach in Florida. In either case, a condo may have seemed a lesser home because where you came from there were far more houses than condos so that living in a condo meant something transitory or temporary. The line between apartment unit and condominium could easily be blurred.

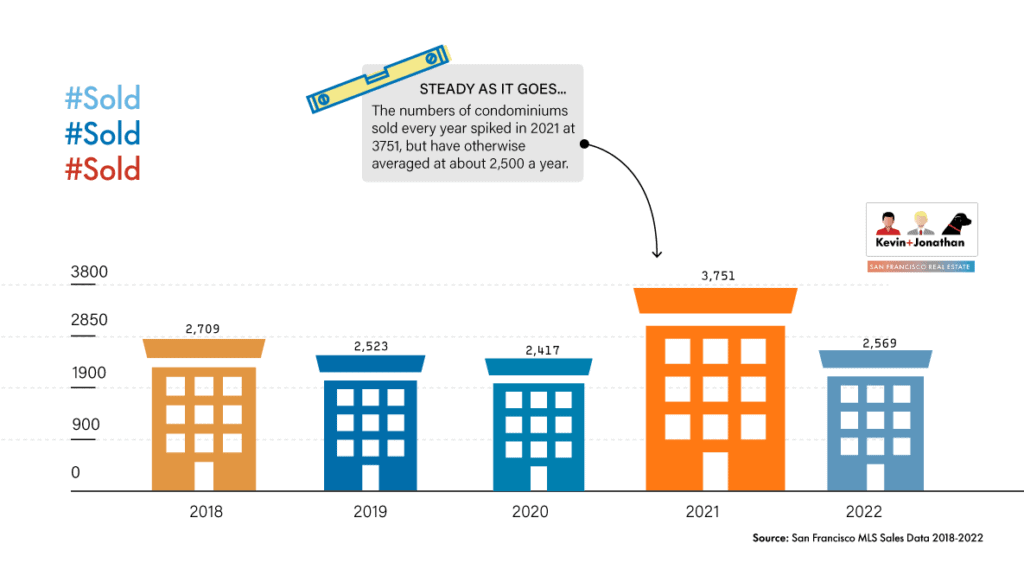

Like a lot of other things, that’s not the case here as condominiums are not only a great way to get into homeownership but may well be the end goal opposed to owning a single-family house. In a given year, anywhere from 2,500-3,000 condos sell (although 2021 saw nearly 4,000), which is just a little more than how many single-family houses sell annually.

Forget the condo in Boca or the anonymous, singles-only, low-rise golf-course abodes on the edge of town that you may have associated with condos if you’re not from San Francisco or New York

2023 UPDATE

How will remote work impact demand and pricing of Bay Area housing?

The shift towards remote work has greatly influenced buyer preferences and led to changes in the housing market in San Francisco. Previously, those who were able to purchase a home in the city may have prioritized commuting to work. Home may have been just a place to sleep. As a result, denser, newer, mid- and high-rise condo buildings located close to downtown/South Beach/Dogpatch were in demand.

Rarely going into the office now means buyers want larger homes in walkable areas near parks, coffee shops, and other amenities instead of amenity-buildings or proximity to downtown, mass transit or freeways. For many, this means choosing a Victorian- or Edwardian-era condominium in the central parts of the city.

Sales data confirms this trend. While there’s been a 15% decline in the total number of condos sold in the first quarter in 2023 compared to 2020, pre-1979 condos actually experienced a slight uptick in median sale price of $9,000 to $1.4 million. Post-1979 condos, however, saw a decrease of approximately $140,000 in median sale price to $1.03 million, while also taking twice as long to sell in 2023 compared to 2020, which also means there’s opportunity out there for more people to buy than before.

Big Picture Items

Before we delve into the details, here are some high level considerations.

What sets a San Francisco condominium apart from condos elsewhere?

In a densely populated place like San Francisco where land is scarce, people were left with few alternatives other than building upwards and more densely than you would ordinarily do in most of the other parts of the country. Condos are the most traded property class in San Francisco and the variety you can encounter, own and buy is incredible. From the modest studio to the penthouse in the sky.

The Pros

• Lower average price point but higher $/sqft

• Collective responsibility and management of building and common areas

• Possibly exempt from Rent Control laws for San Francisco but still subject to eviction control potentially.

• Desirable inventory in desirable locations (planning and zoning favors more people enjoying a location through raising population density)

• Sophisticated developer and designer focus on this product category because its kind is so common here

• Lifestyle choice: You have full-amenity buildings with door people, gyms, and spas to the bare-boned

• Various legal protections for buyers of newly built condominiums for the first 10 years of a building’s life (right to repair act)

• Lifestyle, part 2 — depending on where, may be perfect for owners who travel, own multiple homes, or ones who don’t want to be bothered with mundane things like mowing the lawn or cleaning the windows

The Cons

• Less independence because of Homeowner Association prerogatives, conflicting personalities, arcane rules and governing HOA documents and bylaws

• Close quarters with neighbors (more sound transmission, less privacy and freedom)

• Shared common areas (lack of yard/parking/storage)

• Risk that other neighbor actions will impact you financially (a remote foreclosure risk)

• Risk of a chilling effect on ability to sell if HOA-wide legal issues arise

• HOA dues and assessments aren’t cheap and you may pay for things you don’t use — also, how much more debt would those amenity fees cover instead?

• Less flexibility to rent to short term (like Airbnb) or to take possession back of your plans change

Starting Details

Okay, now that’s out of the way, here is some more...

What is it that you get with a condominium?

Legally speaking, when you purchase a condominium, you’re usually buying title to a subdivided, three-dimensional space within a “common interest development,” that doesn’t necessarily have to be connected to the ground, but the rules, restrictions and conditions that you agree to abide by when buying a condo do ‘run with the land,’ technically speaking. A condo ‘unit’ can be bought and sold, financed and bequeathed through a will or trust like a single-family house can be. Because of this flexibility and alienability, most lenders will lend on a condo purchase. (Contrasted with a tenancy-in-common purchase which most lenders find incomprehensible and unlendable).

How Much Are the Monthly Dues?

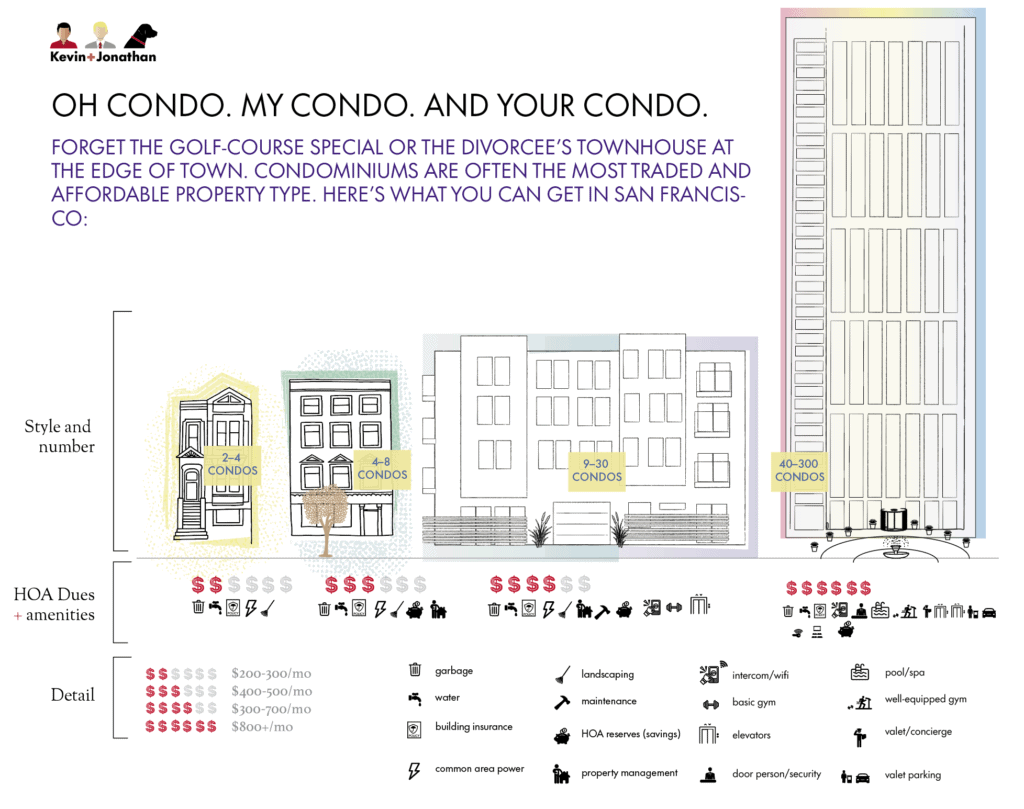

The variation we see in condo inventory also shows up in monthly HOA fees, which usually cover building insurance, trash, water and common area electricity at minimum.

Of course, you get for what you pay for because the more amenities there are the higher the monthly dues will be. Ultra-luxe buildings with lobby attendants, concierge services, valet parking, and more will command higher and higher fees — think the St. Regis, One Steuart Lane, 181 Fremont, the Four Seasons, etc. Amenities can range from morning breakfast, cleaning, and lounges. Most costs are, of course, based on labor costs as having more people working means more money is needed.

Now there are some buildings that have LEED certifications (the Arterra in China Beach) which drive down costs while others may have virtual attendants or part-time ones. Many smaller HOAs — say the 2- to 4-unit buildings — will either not collect regular dues opting for a pay-as-you-go approach — or collect a very low amount waiting to collect a special assessment when a big-ticket items pops up.

The Range of Monthly Association Dues/Fees

Our experience with buying and selling so many condominiums in the City tells us what to expect generally, but inflation has hit this realm too and dues have been going up (and up). Here is what you will likely see out there"

- Pay-as-you-go to $0 to ≈$200/mo per unit for units in 1-2 unit buildings (Victorians, Edwardians, Mid-Century): Dues include garbage, water/sewer, common area electricity, common area insurance; maybe a landscaper. Be alert for big-ticket special assessments as operating account and reserve accounts are usually lower than they ought to be. If there is earthquake insurance, the dues will be at least $700/month.

- $300-$700+/mo per unit for units in 2-4 unit buildings. Includes all the above services, may also include some element of management or accountant. Be alert for (same as above), but also be prepared that things like roof maintenance or plumbing issues which may well be more significant because you straddle the line between smaller and larger buildings whereby certain costs and systems work is just more expensive and/or conditions merit required updates (sprinklers, power service) that are more expensive. Possible lurking special assessments there may be deferred maintenance for fences and exterior stairs (which will cost anywhere from $10K-$40K) One other note: be alert for social dynamics for buildings of this size in decision-making whereby you can have a hold-out or you may have personality clashes.

- $600-$900+/mo per unit in medium (10-25 units) to larger buildings (25 units+). Dues should include water, garbage, common area insurance, common area power but also should include a delineated amount for HOA reserve accounts (long-term savings for replacing aging building systems over time according to a 30-year useful life for most elements). Dues are higher for buildings with elevators (service contracts are expensive, repairs are costly, replacement is very costly). Amenities like gyms, security, janitorial, and attended lobbies are also high cost centers.

- $1,000-$1,500+/mo per unit in larger, full-service buildings (50+ units). Dues should include all the above (reserve contributions is important) plus management. If staff is 24 hours or if there are more elevators, dues increase large buildings with lobby attendants, services, common areas like lounges, party rooms, parking

- $2,000-$3,500+/mo per unit in larger, full-service, luxury buildings. These are the named, branded, full-service concierge buildings with marquee services and amenities, closer to a full-service hotel experience in certain respects.

The Biggest Line Items

What items drive up monthly assessment fees:

- People who provide those services (parking valet attendants, concierge services, door people)

- Earthquake insurance (most HOAs do not have coverage, the ones who do see fees go up significantly)

- Pools/gyms/common area lounges (equipment, labor and extra insurance costs)

Amenities (the fringe benefits like breakfasts, housekeeping, planned events) - Business centers (office space, copiers, computers, supplies)

- Common Heat or Water

- Packaged Internet, cable or phone (Webpass for example)

- Renovations (common area maintenance, improvement, roofs)

- Reserve-building (big HOAs are required to do ‘reserve studies’ which will examine common area elements, materials and systems and their expected life expectancies and replacement costs to arrive to a monthly set-aside assessment to save up for these items)

Being an HOA Member/Dealing with the HOA

The biggest externality of buying a condominium isn’t the building per se or the lending aspects of a purchase, but your fellow owners and the HOA as they are literally stacked on top of you, beside you or under you. Let’s take a look at what you can expect.

HOAs generally and what they own

Lots of suburbs or even in some places in the City will have the townhome/zero-lot line condominium development where the Homeowners’ Association will tell you what color you can paint your exterior or that your lawn needs to be mowed. While you may bristle at such authority, by virtue of your purchase you have agreed to be bound by certain documents, rules, conditions under an HOA’s authority.

Buying a condominium also means you’re also buying into that HOA that holds title and authority over the common areas of the development. In an urban setting like San Francisco, common areas usually include the exterior walls, windows (but this could vary), roofs, yards and garages. In larger buildings with more and more units, common areas will include hallways, gym equipment, elevators, and multipurpose rooms and outdoor space like roof decks or pools.

How HOAs are Managed

As for how condo buildings run, the idea of organizing neighboring owners into an HOA is a bit of a nod to collectivism, as owners relinquish some ownership responsibilities of a house (or burdens, depending on your POV) to joint management in exchange for the benefits of pooling resources together when it comes to utility costs, insurance rates and maintenance for example.

How much of your daily experience an HOA will consume is hard to tell unless you’ve lived it but looking at the disclosure documents we get as a buyer will provide a lot of clues. HOAs are governed by a set of codified rules under California’s Civil Code. Most of the rules relate to record-keeping and obligations that HOA board members have when it comes to carrying out their duties on behalf of the owners they represent and for whom they set policy and make decisions.

How Involved You Have to Be

Because the HOA has an obligation to maintain ‘common areas’ as well as to promote resident welfare they are granted certain amounts of power to achieve those goals. For large associations, the HOA will have a Board and that board will hire a property management company. Some HOAs will have formal meetings, others won’t. All HOAs are supposed to maintain financial records and provide annual statements among other requirements under applicable California law.

- The Chill (almost to a fault) Model for most 2 to 4 unit buildings, these informally run HOAs are relaxed to the point of neglect as most people are busy with life

- The Neighbor-Partner Model while still being an informally run HOA, this type of HOA is still on top of things usually because of 1 or 2 of the neighbors care about these things; for buildings up to 6 to 10 units

- The Property Management Proxy Model is when the HOA delegates management to private companies who manage daily matters for the building/development while working with HOA board members through a property manager; typically seen for buildings with 5 or more units

- The Student Council Model is where people may debate matters and disagree with each other; for buildings that are big enough where there’s more than 1 person per board member job)

Delving into the Documents: The Governing Docs of an HOA

There are a lot of documents that are involved with condominiums (and even more for co-ops and tenancy-in-common units). We go over the important ones you should examine below. Because thee issues may implicate legal questions you may need to consult with a local attorney qualified in condominium law. We are happy to provide referrals, just ask.

Document Review

When considering an HOA, we will help you review the usual array of documents related to a condominium. Some of them are recorded with the county and are official documents linked to the parcel itself. The most important are the CC&Rs — the covenants, conditions and restrictions — which is a set of lawyer-drafted documents that spell out the major aspects of the property and development. These documents are usually linked and/or contained within the preliminary title report seller agents provide. In addition to those documents, we should receive others related to an HOA’s financials and recent matters.

What CC&Rs Contain

Here are topics CC&R documents will cover. Most CC&R docs will be organized roughly in the same way,

- Which parts of the building belong to the HOA and individual owners (i.e., what a ’unit’ is)

Parking, storage, decks/patios, exclusive use - HOA officer elections, decision-making, if there are weighted voting/procedures

- Insurance requirements, management fees

- How HOA money is raised, spent and managed (dues and assessments)

- Pet policies (usually 2 pet limit, weight limit, certain dog breeds prohibited)

- The ability to lease a unit/short-term rental (usually 30 days or longer)

- How remodeling and repairs are supposed to be done

- What happens if the building/development is destroyed

- Quiet hours/carpet coverage requirements for sound transmission minimization

- Allowed signage, prohibition of onsite car repairs, garage sales, hanging laundry outside,

Other Relevant Docs

Here are topics CC&R documents will cover. Most CC&R docs will be organized roughly in the same way. The amount of documents we get as buyer agents and would-be buyers will vary from just a bare 20-40 pages to times where we get hundreds and hundreds. Here is the range from the bare minimum that’s required to times when we get bucketloads more.

- CC&Rs (and any amendments)

- Bylaws and/or House Rules (see more below)

- The Condo Map of units, parking, common areas, exclusive use areas (patios, decks)

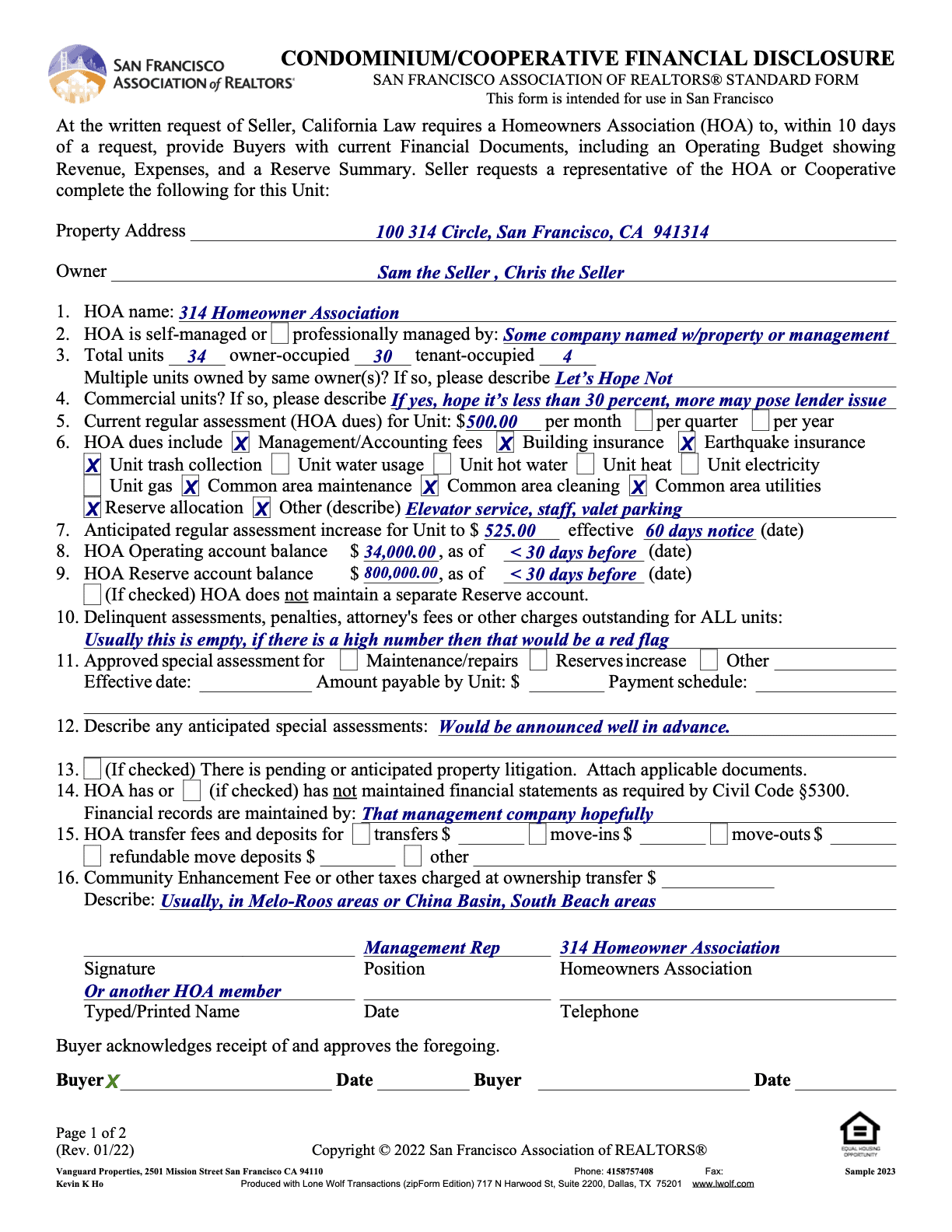

- HOA Financial Certification Form (a standard one showing owner-occupied vs. tenant, HOA bank account balances, current assessments, planned assessments, move-in/out fees, if any owners are in arrears, if one owner owns more than one unit)

- The HOA’s insurance policy

- HOA bank statements (reserve and operating)

- One year of HOA meeting minutes (or explanations of recent business)

- Management contact

- Projected budget (for larger HOAs)

- Reserve Study (study of projected component useful life and replacement of those)

Primary documents for any planned projects/repairs - House Rules (for such things like quiet hours, garbage take-out/take-in duties, remodeling procedures, move-in/move-out procedures/fees)

Other Condo Questions

In our years of working with buyers and sellers of condominiums we’ve learned a lot of the nuances.

Can I buy another unit in the building?

What if there are only two units? In the case of just a pair of units: lenders usually hate this scenario but can do it. You have to expect you to put down at least 40% of the purchase price for the other unit and have a good amount of HOA reserves built up. And before you ask why you’d want to buy both (or all) of the units in a building consider that many folks will buy both units in a building and use it as a single-family house/compound/residence.

What type of insurance do you need for a condo?

Every owner should purchase an HO-6 Condominium Homeowners Policy — a ‘walls-ins’ policy — to insure their own installed fixtures, personal property, loss of use with additional living expenses and/or loss of income and rental income. Coverage should track any lost assessment dues and cover the building’s overall policy deductible and, most importantly, insure for personal liability. For a decent summary, take a read about what HO-6/'walls-in' insurance is and how it relates to a "Master" policy of insurance for the entire HOA when buying in a condominium building here. If you're getting a mortgage, a lender will require you to keep this type of policy in place.

Do Condos Hold Market Value?

The answer is yes, as the data show below.

The Condo Cert Doc & the Lender Form

As the most traded property type in the City with as much variety as San Francisco is able to muster, condominium homeowner associations come in all shapes and sizes. The range of management styles, financials and adherence to applicable laws and regulations governing HOAs in California (the Davis-Stirring Act) goes from informal, pay-as-you-go 2-unit, 2-member HOAs, to ones where there’s a Board, a management company, on-site vendors, contractors and amenities management with dues going into the thousands every month.

The great equalizer among all these possibilities comes with buyers wanting to buy with a mortgage. Every lender will send a questionnaire the HOA that manages the HOA in which you’re interested. Mortgage underwriters review the unit you want to buy along with the HOA too so they can assess the risks to the borrower and the soundness of the mortgage should they ever have to become an unwitting HOA member.

Ownership Information

- Ownership Questions

- Commercial units, if any. If so, what percentage of the HOA does the commercial space comprise?

- If any single owner owns more than 1unit.

- If any owners are behind or delinquent with their dues

- Ratio of owners versus renters onsite

How the HOA is Managed

- HOA Administration

- Smaller HOAs tend to be run informally

- Larger HOAs will have HOA Boards and management

- How money is handled (budgets, financial statements)

- How decisions are made (minutes needed)

- Who has authority to sign checks, disburse funds

- Records kept (record keeping)

- How regularly budget and administration documents are issued to members

- Building-wide insurance policies (copies of which need to be given)

- If there is a separate reserve account (and reserve study)

Dues and Assessments

- How much, due when

- Transfer fees

- Planned increases, special assessments (planned, coming and past)

- What dues cover and documentation (budgets, account statements)

Risk Management/Litigation

Any current, past or anticipated (especially for buildings less than 10 years old)

Any notices of violations, warnings to residents, received by HOA