We’re on the Way Home — Escrow Road

CLOSING THE ESCROW IN SAN FRANCISCO

The Overview:

Escrow as Easy as 1, 2, 3

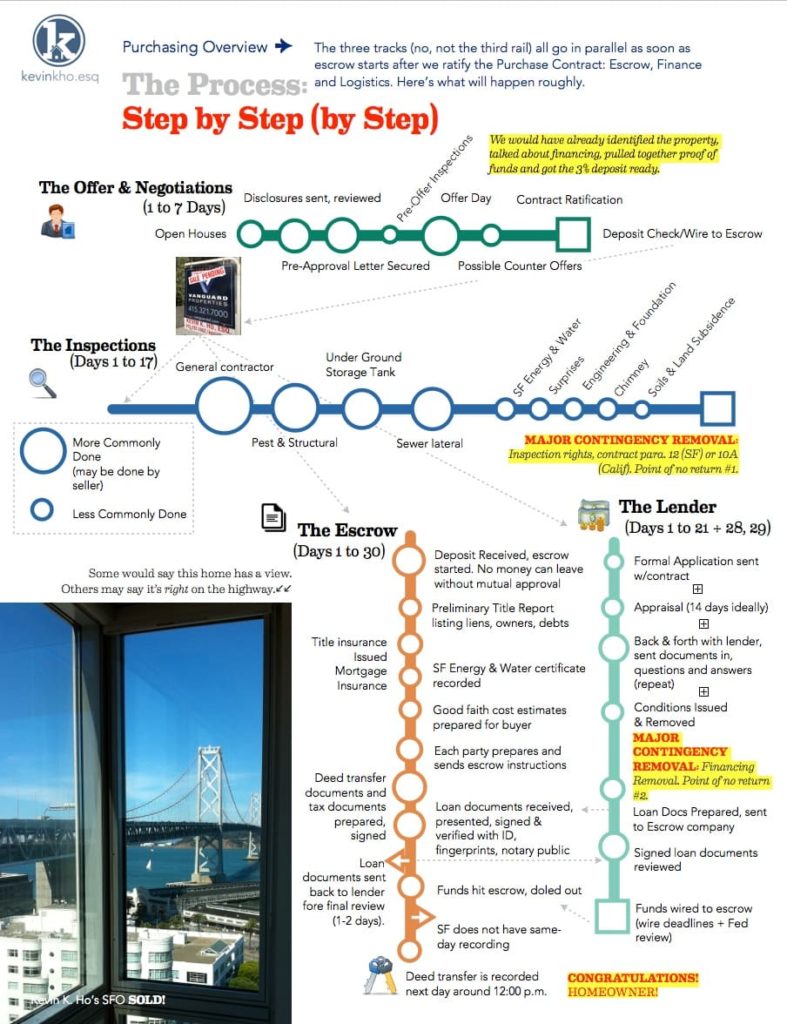

After our offer is accepted and a contract is ratified, we enter into escrow. Title companies such as First Old Fidelity American National Chicago Republic – no, this not a real company, but could possibly be – are the folks enter the picture who will help get all the paperwork and money in order so as to wrap up the title deed transfer to you, which is what all of this is about after all. And with this, activity will shift into one of three main areas that will bring us from having won the property to the day we get keys for it. The three main areas we’ll spend our time on for the next few weeks are:

- The Money (i.e.,financing/funds transfers)

- The Property (i.e., diligence/appraisal/physical conditions or contingencies)

- The Title (i.e., title insurance and how you’ll hold title — vesting)

Wrapping up each of these are vital to the success of our contract and essential to getting you keys when we close.

And just accept it now that there will be a ‘glitch’ along the way. We don’t know what it looks like right now but we do know that we have probably handled and successfully resolved it before. If we haven’t we have loads of resources to be able address it. Remember that everyone is rooting for our mutual success here and we will get there to closing the whole transaction for your new property sooner or later.

MORE ON THE PROCESS

What Does an Escrow Officer Do?

Question: What is “escrow” and how does it work? Is there a scarecrow involved?!

Escrow refers to a neutral third party whose job it is to hold funds, prepare documents and disburse funds for a given amount of time until certain events and conditions occur. Typically, escrow is a title company whose job is to provide title transfer, insurance and recording services to the buyer, seller, brokers, lenders and municipal government. Usually, one person and and assistant are the main points of contact. The escrow officer takes their instructions based on the terms of your Purchase Agreement, party instruction and lending requirements. The escrow officer can hold inspections reports and bills for work performed as required by the purchase agreement. Other elements of the escrow include hazard and title insurance, and the grant deed from the seller to you. Escrow cannot be completed until these items have been satisfied and all parties have signed escrow documents. An important note: escrow can never release monies unless and until both parties have agreed to do so mutually.

The escrow holder is the neutral third party who maintains and runs the process between when an offer contract is accepted to when the deed transfers provided all the agreed-upon conditions are satisfied mutually. They will also be the folks who issue various forms of insurance required for a transaction, its financing and are responsible for telling people what is due and where to send it, as well as preparing all those pesky documents needed to record the transaction. A good officer will be proactive and responsive and will keep us on schedule. A bad one can lead to a host of issues that would make me don my lawyer hat and put our deal at risk. Let’s err on the side of having a good escrow company and personnel, shall we?

Question from Bill Lumbergh: ”If you could just go ahead and tell me what you do here, that’d be great, yeah...” (i.e., what does escrow actually do?)

- Serve as the neutral agent and the liaison between all parties involved

- Assist in the creating joint escrow instructions; implementation of the same

- Prepare and conduct a Preliminary Title Search to determine legal status over the property’s title

- Handle Note issues, i.e., payoff demands, dues, fees owed

- Confirm parties are complying with the lender requirements as specified in lender instructions.

- Receive and handle purchase funds from the buyer

- Prepare the correct and needed the title deed transfer and other documents related to the escrow.

- Prorate and calculate taxes, interest, insurance and rents accurately; collect the same

- Ensure releases of all contingencies or other conditions imposed on the escrow

- Prepare, underwrite and investigate title insurance policy

- If needed, prepare, underwrite and issue mortgage insurance policy

- Facilitate title transfer pursuant to instructions supplied by the seller, buyer, lender or any other third party

- Disburse funds as authorized by escrow instructions, including charges for the title insurance, recording fees, real estate commissions and loan payoffs

- Prepare final HUD statements for all parties that account for the disposition of all funds held in the escrow account as needed for tax purposes; withhold FTB portion if needed

- Manage signing & recording of all title-related documents with County

- Fingerprint signers to confirm identity at signing (escrow officers are usually also a notary public)

When Things Happen... Generally...

Who Pays for What

Local practice and custom dictate who pays what when it’s time to settle up closing costs. By the end of the escrow, the escrow officer has usually reconciled, pro-rated, credited and debited everything down to a daily rate, which is helpful if escrow gets pushed back a day or two (which happens more often than not). Some items, like energy and water conservation inspections are supposed to be seller costs because that’s what the ordinance says. Other items can be negotiated. If any cost-shifting responsibilities are changed and if there’s a mortgage involved, changes should be done in writing and well in advance of closing as the lender will have to adjust their numbers, and, if the change is great enough, new loan docs may be needed.

The Seller generally pays for:

- Real estate commission (split between agents)

- Documentation preparation fees for Deed

- Transfer tax (county), if city, then shared

- Notary fees

- Homeowner Association transfer fee

- Interest accrued, statement fees, reconveyance fees and any payment penalties Any judgments or tax liens Tax proration of any unpaid property taxes

- Any unpaid HOA dues

- Any and all delinquent property taxes, bonds or assessments

The Buyer generally pays for:

- Title insurance premiums (not in Santa Clara County)

- Escrow fee (not in Santa Clara County)

- Document preparation

- Notary fees

- Recording charges for all documents in Buyer’s name

- Any loan fees required by Buyer’s Lender

- Inspection fees (pest inspection, property inspection, roofing, geological)

- Tax Proration (from the date of acquisition)

- All new loan charges

- Interest on new loan from date of funding to thirty days prior to first payment date

- Assumption/change of records fees for takeover of existing loan

- Fire and Hazard insurance premiums for first year (depends on lender)

Time to Click

DocuSign Thanks You

The DocuSign company should be a sponsor real estate given the number of docs we use DouSign to sign. Its true that an e-signature is as valid as an ink one except for when it comes to mortgage docs and deed transfer docs, which have to be signed in person, in ink, before a notary public.

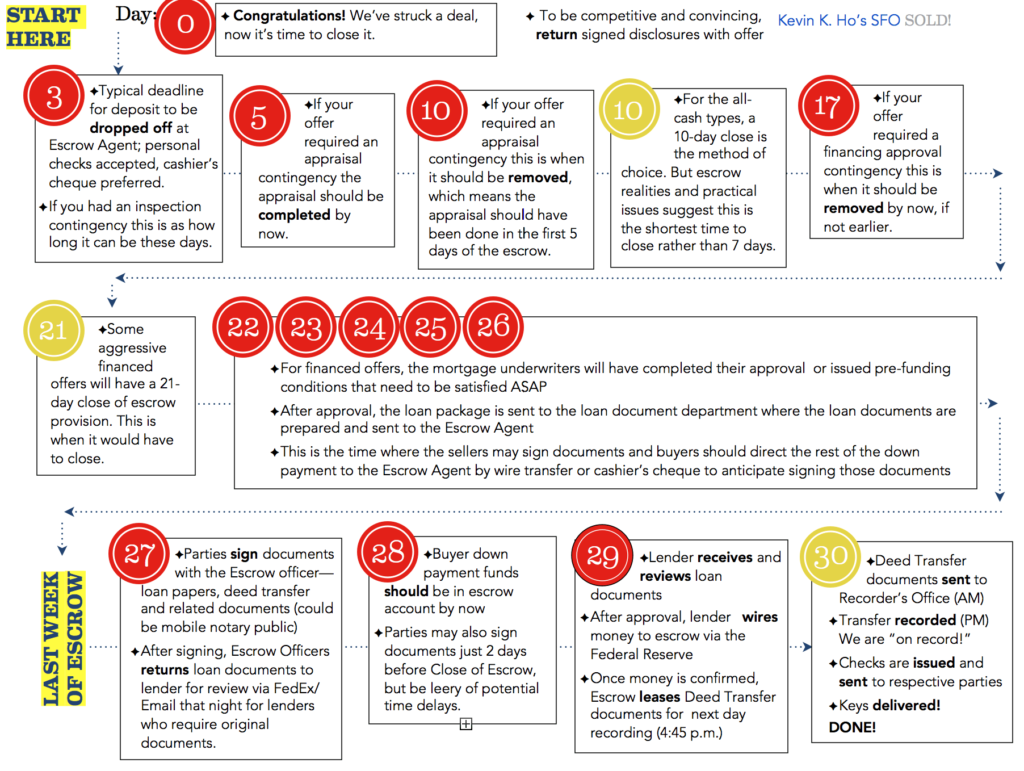

Typical Deadlines + Timelines During Escrow

3% DEPOSIT: 1-2 BUSINESS DAYS (3 AT MOST)

IF TAKEN, FINANCING: 7–21 DAYS

IF TAKEN, APPRAISAL: 7–21 DAYS

ANY REMAINING CONTINGENCIES: 21 DAYS

(FOR LOANS ONLY): CLOSING DISCLOSURE 3 DAYS BEFORE DOCS CAN BE SIGNED

MORE DETAILS

Contingency Removals and Title Insurance

When is X, Y or Z Due? Contingency Removals and You

Our Purchase Contract will contain all of the deadlines and relevant dates for the various conditions and contingencies the parties need to remove before escrow can close (that is if we had any contingencies).

Most commonly referred to as “contingency removals” usually take place according to the escrow timeline and schedule below which is the default used in the SFAR form. This is when and where deals will either fall apart or succeed.

Adjusting these dates — the terms— in the Offer Contract may make our offer stronger or comparatively weaker than others. Adjusting timelines during escrow is also possible, but beware if there is a ‘better’ backup offer ready, willing and able to go. Last, according to the Statute of Frauds, matters affecting real property like amendments or removals, must be reduced to writing to be valid.

Home Warranties

Home warranty/protection plans are generally offered by third-parties (often affiliated with the escrow/title company) to a buyer or even a seller. These of the plans may provide additional protection of certain systems and appliances in the home. It’s always a good idea to get these programs as they cover most appliances and home systems. If our property is new construction, then certain statutory protections will apply too as will original manufacturers’ warranties.

Question: What is Title Insurance?

Apart from the purchase price, the next cost buyers notice is title insurance. This insurance is designed to protect you when you sell the property in the future by insuring that you will have clean and marketable title to sell – free of any ‘clouds’ on title. On the face of it, coverage looks to be limited because it only goes forward and doesn’t necessarily look backwards.

It’s confusing and technical I know, but think about it this way: how else would you have a clean title to sell if you didn’t start with one? So yes, standard title insurance policies cover against presently known liens or encumbrances valid or not during escrow, but these policies also typically cover a defective chain of title search too. (See, Insurance Code §12340.1; DiMungo & Glad, California Insurance Law Handbook, 2009, §78:2).

So what happens if a creditor of the previous owner pops out of the woodwork and files a lien, will I be protected?

Insurance companies will (and should) try their hardest to ascertain who may have a claim on against a property during the escrow and underwriting process; otherwise they may face claims of negligent search/due diligence, exposing them to liability and, therefore, coverage. (See, e.g., Barczewski v. Commonwealth Land Title Ins. Co., 210 Cal. App. 3d 406 (1989)). Moreover, if a policy is ambiguous or illusory the California Supreme Court has said that the policy will be honored so as to give the policyholder the protection s/he reasonably expected. (AIU Ins. Co. v. Superior Court, 51 Cal. 3d 807, 822 (1990)).

Last, there are certain “off–record” risks that a standard policy should cover anyway including forged or altered deeds. (See, e.g., Safeco Title Ins. Co. v. Moskopoulos, 116 Cal. App. 3d 658, 665).

For precise tilte policy language see: https://www.alta.org/forms/

Those Closing Costs...

Closing Costs or settlement costs are an accumulation of separate charges paid to different entities for the professional services associated with the buying and selling of real estate. Each side will prepare escrow instructions shortly before closing to advise the escrow company on who is paying what and when.

Seller costs usually just involve transfer tax (depending on the county), reconveyance fees (for their note), prepayment penalties (if any) and commissions)

Listed below is a little more information about typical closing costs for the buyer.

- Appraisal:

This is a one-time fee that pays for an appraisal – a statement of property value for the lender you're using. Typically each lender must get their own for a given property. The appraisal is made by an independent appraiser. The typical expense is about $500-$800

- Credit Report Fee:

A one-time fee that covers the cost of a special lender's version of your credit report. Typical cost: $20.

- Loan Discount Points/Buy Down:

A one-time fee used to adjust the yield on the loan to what market conditions demand, called “points.”

- Loan Origination Fee:

The lender’s administrative costs in processing the loan are covered by this fee — if any.

- Mortgage Insurance (Private Mortgage Insurance PMI/Mortgage Insurance Premium):

Mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. FHA, Freddie & Fannie requirements include mortgage insurance primarily for borrowers making a down payment of less than 20 percent. Also, you may be required to pay an upfront fee for mortgage insurance for Conventional and/or FHA loans of more than 80 percent loan to value (i.e., less than 20 percent down), depending on the amount of your down payment. Plus, you will pay monthly PMI or MIP after Close of Escrow; for FHA loans you would pay approximately 1 percent of the amount borrowed (actual amounts are based on basis points) for a number of years until you get to 20 percent +1 month equity. Lenders may also require monies be placed into an impound/escrow account every month for a certain period of time to be held by them so that property taxes may be paid from this account. At the close of escrow lenders may require prepayment of a month as mortgage payments are done in arrears.

- Daily Prepaid Interest:

Depending on the time of month of day of week your loan closes, this per diem charge may vary from a full month’s interest to just a few days. If your loan closes at the beginning of the month, you will probably have to pay the maximum amount; if your loan closes at the end of the month, you will probably only have to pay a few days’ interest. You may also have to pay for holding the loan over a weekend if the money arrives on a Friday but you can't record a sale until Monday.

- Taxes and Hazard Insurance:

You may be required to reimburse the seller for property taxes, prorated depending on the month in which you close. You may also need to prepay a year’s homeowner's insurance premium before close of escrow. Also, you might be required to put a certain amount for property taxes as impounds into a reserve account held by the lender. Conversely you may get a property tax credit back again depending on the time of year your escrow closes.

- Title Insurance Fees:

There are usually two types of title insurance policies a buyer is obliged to pay. The first is an owner's policy. This policy will protect a buyer against any issues with the title deed such as incorrect boundary lines or incorrect legal descriptions and/or undiscovered debts secured by the property in question. This policy fits in the chain of ownership as the buyer (or their heirs) will eventually become a seller one day and having as policy in place during a seller's tenure will make that future sale all the more easy. This policy lasts the duration of ownership. The second is a policy that protects the lender during the time they have a mortgage on the property (see below for more).

- Transfer and Assumption charges

Fees charged by a lender to allow a new purchaser to assume an existing loan if your purchase is structured in such manner (this is pretty rare nowadays and was more common for group loans for TIC buildings).

- Recording Fees

Fees assessed by a county recorder’s office for recording the documents of a real estate transaction.

- Loan Fees

Fees charged by a lender in connection with the processing of a new loan (if applicable). These may include points, origination fee and credit report.

- Escrow Fees

Fees charged by a title and/or escrow company for services rendered in preparing documents necessary in the consummation of a real estate transaction (aka, everything we’ve talked about here).

JUST IN CASE...

Belay or Delay?

Chances are there will be a glitch or delay during the escrow, which is fine. But when it gets down to the end, what happens?

Closing Dates Are Set in Stone… Except for When They’re Not

The purchase contract will say when Close of Escrow will be, on which the buyer is supposed to have all their money to escrow and when the seller are able to deliver clean title over the property. When parties miss these dates there are a few things that can happen. There’s a built-in 2-day grace period into San Francisco’s contract whereby a breach of that contract can be identified by one of the parties with the other side getting 2 days to cure that breach but this will only happen if the non-breaching party serves a Notice to Perform, which is when the clock starts ticking on the 2-day cure period. (See Dec 2021 contract at para. 42)(The statewide California contract tracks this 2-day period at para. 14.E).

An example: Assume Bill and Sally agree that escrow will close on Sally’s property that Bill is buying on a Monday. Monday comes and goes and Sally hasn’t signed the deed transfer document while Bill and his lender’s monies are at escrow. Bill is ready, willing and able to close. Sally isn’t. Tuesday nothing happens. On Wednesday, Bill’s agent sends Sally’s agent a Notice to Perform, which gives her until Friday to close the sale. The clock didn’t run until Wednesday. If Bill asked his agent to send the Notice to Perform on Monday, Sally would have had until Wednesday to close. If the Notice went out on Tuesday, Sally would have until Thursday to perform. If Sally doesn’t perform by the response deadline a whole lot of ‘bad’ things can happen including lawsuits or returns of deposits, etc.

Delays Can Happen from Either Side; Costs Can Start to Add Up

But let’s assume that there’s something reasonable holding up the sale. Usually, it’s the buyer and their lender who need more time but there are times, like here, where the seller, for whatever reason, cannot close as promised. This may involve building permit delays for new construction, or, in the case of a TIC, delays from other transactions or from the lawyers. Because time is money, there are certain costs on either side can start to add up if closing is delayed. Those costs can add up significantly.

The normal practice for these occasions is to have the side unable to perform, credit the non-breaching side their prorated daily carrying costs or extension fees. We’ve seen daily rates as low as $70/day to $150/day give or take usually in the form of a credit through escrow as the costs should be relatively minor if the delay is short. If there is a delay of a day or two both sides tend to ignore it under the assumption that it all comes out in a wash anyway. Beyond a day or two is when people start getting nervous as costs that would not have otherwise been incurred but for a delay, can start to accumulate. This is when additional addenda get prepared to outline next steps, landmarks and “what-ifs” so that there’s a working game plan to see the transaction through, or, if it wasn’t meant to be, disentangle everyone involved best possible while hopefully avoiding litigation.

Usually, these addenda will have some cost shifting or adjustments built in. For example, if we represented a buyer whose lender was being slow but who was otherwise ready, willing, and able to go, we’d confirm that the initial earnest money deposit was non-refundable and may suggest that the escrow officer go ahead and disburse some of those funds to the seller as it is just a matter of time before all the monies come into escrow. On the seller side, assume there was a delay of some kind that will get resolved shortly, it may be possible to work it out so the buyers take possession earlier than the close (but you have to be very, very cautious with this approach and should consult brokers and/or attorneys to understand what this would mean given your circumstances). There are tons of variations to this fact pattern but suffice it to say, delays happen and there are some grace periods, but at one point there will need to be a clear set of marching orders for everyone, and expectations will need to be set.

Our Record (of Excellence, Experience, and Wisdom)

Over the years we’ve been privileged to have helped so many buyers and sellers with their purchases and sales in San Francisco and beyond.

250+

ESCROWS

We surmise that Mr. Raffi has been to more closings in San Francisco than most agents!

$320,000,000+

SALES VOLUME

And growing. Ever since we started doing San Francisco real estate our trajectory has been up and up, through the good times and the tougher ones too.